Ready to gain a clear picture of your financial health? A personal net worth statement is your key to understanding your overall financial situation. This comprehensive guide will walk you through creating a powerful net worth statement using a simple, customizable Excel template. We'll cover everything from understanding assets and liabilities to interpreting your results and setting actionable financial goals. Let's get started! For more advanced net worth tracking, check out this resource.

Understanding Your Assets and Liabilities

Before we dive into the Excel template, let's clarify some fundamental terms. Assets represent everything you own that holds monetary value, while liabilities represent your outstanding debts. The difference between your total assets and total liabilities equals your net worth. But why is this essential? Knowing your net worth provides a clear snapshot of your financial health, empowering you to make informed financial decisions.

Categorizing Your Assets

To accurately calculate your net worth, we need to categorize your assets. Here's a breakdown of common asset categories:

- Liquid Assets: Easily accessible cash, including checking and savings accounts, and readily available funds. This is your quick-access money.

- Investments: Growth-oriented investments like stocks, bonds, mutual funds, and retirement accounts. These have the potential to appreciate over time.

- Real Estate: Property you own, such as your home, rental properties, or land. Its value fluctuates, so accurate valuation is crucial.

- Personal Property: Possessions with monetary value, including vehicles, jewelry, valuable collectibles, and furniture.

Categorizing Your Liabilities

Similarly, understanding your liabilities—your debts—is crucial. Let's categorize them:

- Short-Term Debt: Debts requiring relatively quick repayment, such as credit card balances, short-term personal loans, or medical bills.

- Long-Term Debt: Debts with longer repayment periods, including mortgages, student loans, and auto loans.

Accurate categorization is critical for an accurate net worth calculation. Did you know that an inaccurate net worth statement can lead to flawed financial planning, potentially hindering your progress towards financial goals?

Creating Your Personal Net Worth Statement in Excel: A Step-by-Step Guide

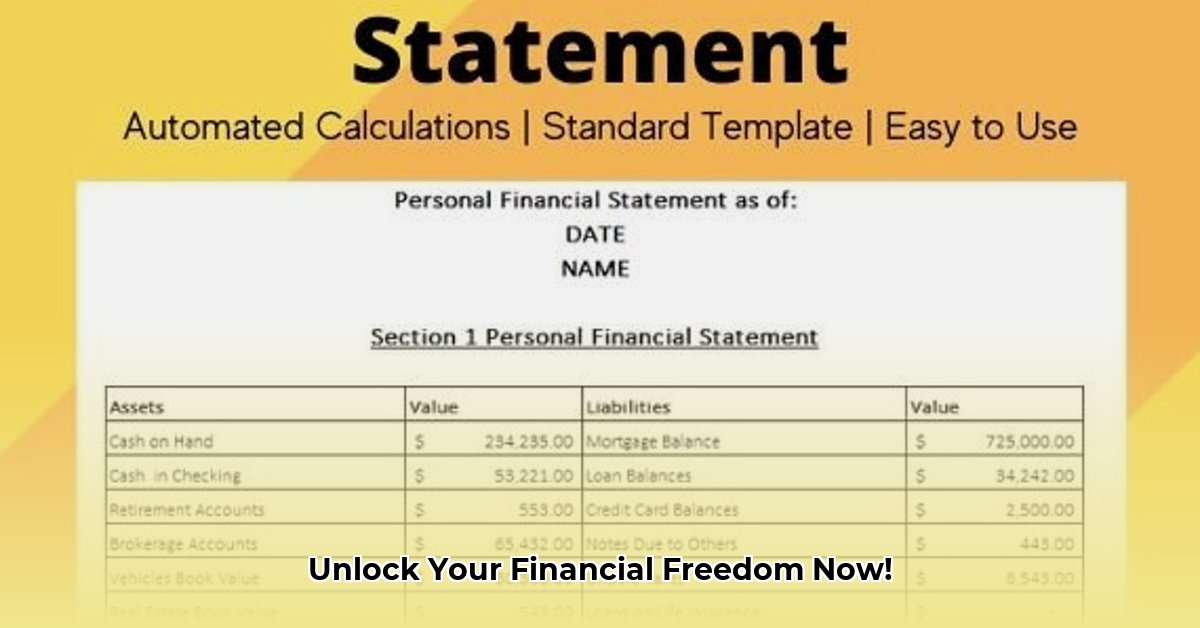

Now, let's build your net worth statement using a user-friendly Excel template. This practical approach allows you to easily track your financial progress over time.

Download the Template: Numerous free templates are available online. Search for "free personal net worth statement template Excel" and select a template that suits your preference. (Example: https://exceltmp.com/personal-net-worth-statement-template-for-excel/)

Open the Template: Download the template (usually an .xlsx file) and open it with Microsoft Excel. Familiarize yourself with the layout; most templates include clear sections for assets and liabilities.

Populate the Template (Assets): List all your assets and their current values. For investments, use your brokerage statements for accurate market values. For real estate, use a recent appraisal or a reliable market value estimate. Accuracy here is key. Have you considered using online tools to help determine a current market value?

Populate the Template (Liabilities): Record your outstanding debt balances. Include interest rates if possible to monitor debt reduction progress. Is it easier to track debt reduction when utilizing a spreadsheet?

Categorization: Organize your assets and liabilities according to the template's categories. If needed, customize the template to add more specific categories.

(Example Table - Insert a simple table here showcasing asset and liability categories with sample entries.)

| Category | Asset/Liability | Amount |

|---|---|---|

| Checking Account | Asset | $2,500 |

| Savings Account | Asset | $10,000 |

| Investments | Asset | $25,000 |

| Car | Asset | $15,000 |

| House | Asset | $300,000 |

| Credit Card Debt | Liability | $2,000 |

| Student Loan Debt | Liability | $15,000 |

| Mortgage | Liability | $200,000 |

Calculating Your Net Worth

The beauty of an Excel template is its automated calculation! However, understanding the formula is beneficial:

Net Worth = Total Assets - Total Liabilities

Your template will automatically calculate this, providing a clear summary of your financial standing. It's a simple calculation, but its significance for your financial planning is immense.

Analyzing Your Results and Next Steps

Your net worth is more than just a number. It's a reflection of your financial health. A positive net worth signifies your assets exceed liabilities, which is excellent! However, a negative net worth indicates you owe more than you own. This isn't inherently negative, but it signals a need to scrutinize your spending habits and debt management strategies.

Regularly update your net worth statement—monthly or quarterly—to track your progress and make necessary adjustments to your financial plan. Consistent monitoring helps you maintain financial awareness and build sound financial habits.

Additional Resources and Tips

Numerous budgeting apps can enhance your net worth statement, offering additional financial tracking and planning tools. Remember, a personal net worth statement is a powerful tool that, when used correctly, can lead to significantly improved financial planning.

Conclusion: Embark on Your Financial Journey

Creating and utilizing a personal net worth statement in Excel is a significant step toward improved financial management. It provides clarity, empowers informed decision-making, and sets the stage for achieving your financial goals. Start tracking your net worth today and embark on the path toward a more secure financial future!